Published on 15th March 2020 by CREBACO Global Inc.

The Global markets have been correcting since last few days.

Some blame it on CoronaVirus, some curse on crude oil.

But when Bitcoin corrected by over 50% in 36 hours, CREBACO decided to run an intelligence report to analyse what happened.

Before we start, let’s look at a few aspects which are needed to be understood for our conclusion.

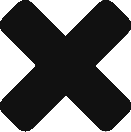

Global Market Condition

The CAC, DAX, S&P, Nasdaq, HK Stock Exchange and Nikkei and few other global equity markets collapsed at the same time by approx. 20% on an average. Oil stocks suffered the most due to Crude oil price issues between Saudi and Russia.

But that wasn’t the only reason Bitcoin crashed as well. There were several reasons for the global markets to crash. Let us look at some of the aspects.

Long due Recession

The recession had been anticipated since the last 2-3 years as many analysts predicted it looking at the yield curve and other economic aspects. The US economy being the biggest indicates whether it’s recession or not.

The yield curve is an incredibly accurate tool for understanding and predicting recession and US economic conditions. Yield curve is nothing but short term and long term interest rates given by the treasury.

Flattening yield curve is not looked at with positivity. But when short term interest rates become higher than long term interest rates, it is usually an indication that the economy is in recession.

Currently the short term interest rates are approximately 0.5% for 10 year and 1% for 30 year bonds.

Furthermore, a recession was due as the historical charts indicates that every 10 years on an average, there is a correction in the global financial markets.

There was a small correction in the market in 2018 but it was not enough.

This indicates that the US dominates the entire global market single handed.

We investigated for the reasons to find out why the United States dominates the value in the economy and why the US treasury bills are so important. The answer is Gold.

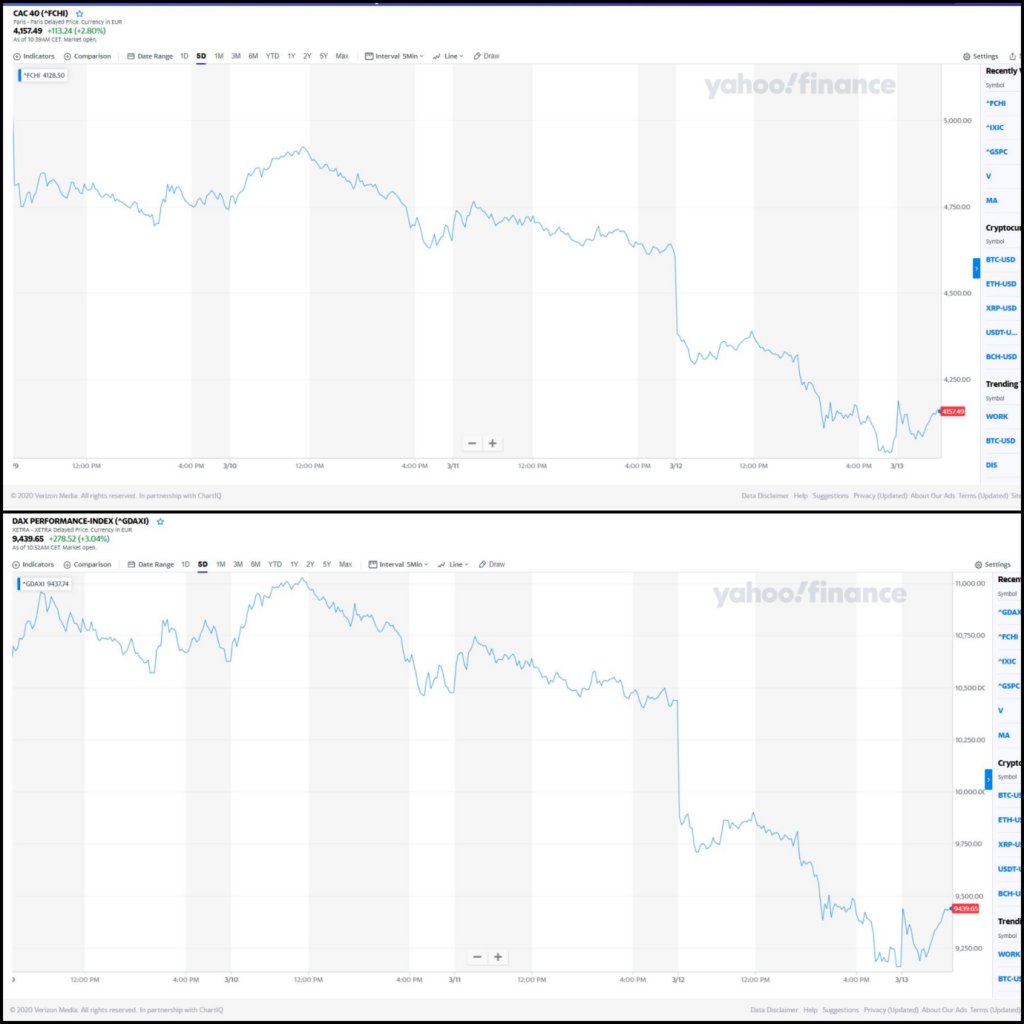

GOLD (Is it a safe haven?)

The US has the highest gold reserves in the world 8134 tonnes followed by Germany which is just 3367 tonnes. Even if Germany doubles its gold reserve it would not match the United States.

So is gold the strength behind the United States?

The world looks at Gold to be a safe haven asset.

During recession and adverse economic conditions gold has proved to be the safest asset to invest in since the last three thousand years of its history.

We have observed that the price of gold starts to move up in the market during recessions and negativity in the geo-political situations. But at the same time the US has the biggest gold reserve and hence, when the price of gold goes up, the US gold asset value goes up as well making the United States and its economy stronger which most don’t realise.

But now gold is being inflated as there are price manipulations. Few of the top banks were manipulating gold bonds, surprisingly the news was not very hyped.

Gold is not the only thing which makes the US economy strong; the US has one of the top multinational corporations in the world who also contribute to the economy.

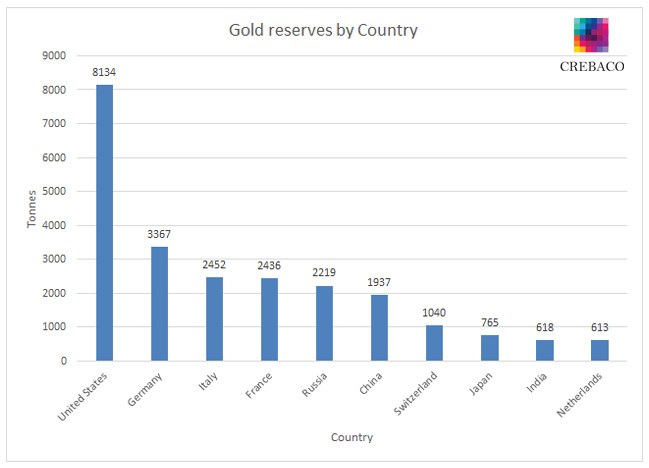

CRUDE OIL

During 2014 Russia agreed to co-ordinate with the OPEC countries to control the production and pricing. But on Friday 6th March 2020, the OPEC and Russia did not agree on the Brent crude production and its prices. Following which Saudi Arabia dropped the prices by 35% making the crude reach about 30 USD starting the so called Oil war. Crude oil saw its strongest fall in 29 years.

The United States has a treaty with the major gulf nations where the US dollar is pegged. This means that even if the currencies fluctuate the US dollar and the gulf nations’ currency will not be volatile.

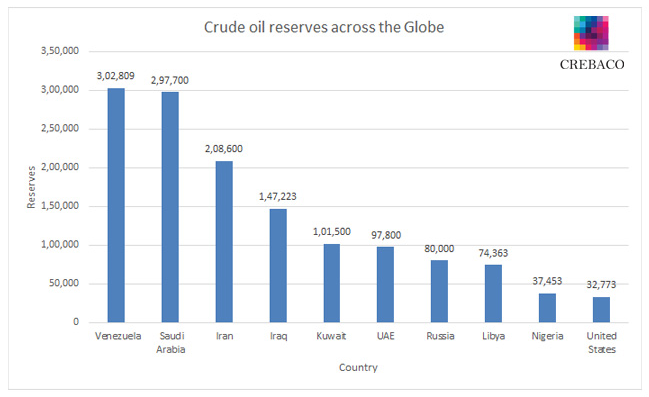

The US had also started extracting shale gas which is now revolutionary. Shale gas is more efficient but at the same time the extraction cost goes above $40. But when we put together shale gas and crude oil, the US becomes the world’s biggest oil and natural gas producing nation in the world. US Seems to be focusing on Oil more inspite of low reserves compared to other countries.

During Recession we have observed a drop in consumption of oil as the manufacturing sector stops or reduces the production. Now the production will go down even further because the raw material for majority of the manufacturing done across the world is taken from China. As per the latest information received by CREBACO for the Chinese production status, the production is now at 10% capacity. This will be first given to Chinese manufacturing. So we can’t expect Chinese exports to resume in the next 4-6 months.

This will significantly affect the oil supply-demand positions.

COVID-19 and China

China is the world’s largest producer and largest consumer at the same time due to its high manufacturing and large population.

We all know that China has emerged as a superpower in the Global market by supplying almost everything in finished or in raw material forms

The trade situations between the United States and China are not very friendly since a few months and there has been a cold trade war between China and America.

China was at its peak, but sadly it was hit by coronavirus also known as COVID19 in December 2019 which has already claimed more than 6500 lives globally. Some sources say that it evolved from mammals and some also claim that it was a leak from China’s class four biological lab. We don’t know that yet but the world requires major medical support to curb the spread of the virus.

72% of the world’s pharmaceutical supplies and over 90% of the medical equipment are made in China. When the world needs the equipment and supplies the most, China is unable to provide due to restrictions caused by COVID19.

SAFE HAVEN 2.0- BITCOIN

The world was observing this new asset class which was claiming to be the new gold 2.0, which was transparent, decentralize and peer-to-peer based on blockchain technology.

But all were struck by surprise when Bitcoin fell by 50% in 36 hours.

Bitcoin is a non-correlated asset which fundamentally has no relation with Geo political and global financial situations. Then why did Bitcoin fall so much at the same time?

It’s the market size.

The Bitcoin and crypto market size was less than 265 billion Dollars before the crash, but Global economies were in trillions of dollars. It is too tiny to handle something like this as it is Bitcoin’s first recession.

Due to the market size, institutions were not involved in trading and providing liquidity to the Crypto market.

The market plummeted due to the spread in trade prices at several exchanges which trade digital assets like Bitcoin.

Usually the liquidity providers control traditional financial markets for keeping the spread in the stock markets stable but when the market falls, they don’t provide liquidity as that results in there losses.

The Crypto market is very small and does not have liquidity providers like the traditional financial market, making it more volatile and vulnerable for sudden falls.

According to CREBACOs observations, the market fell drastically as there was a very thin order book in major exchanges and they didn’t have liquidity providers to support the sudden crash.

Another reason is the traders sentiment based on the global financial situation. Also the volatility of the Bitcoin market is that it is not regulated at most places and that’s the reason why many speculate the prices of Bitcoin. The Crypto industry is relatively new and is full of newage nascent traders which have also been one of the reasons why Bitcoin faced a sharp fall.

Over $665 million longs liquidated on Bitmex exchange and overall the market faced a whopping loss of 16.5 Billion USD in a matter of Minutes for long positions across exchanges. The crypto market size shrunk to approx. 155 Billion USD in less than 36 Hours.

We must not only blame the Bitcoin here., Gold also corrected by approx. 8.5 % in 2 days which is massive for a 3000 year old stable commodity.

Bitcoin is capable of recovering 50% fall in few days which we must not ignore, we can say the same for the equity markets as they all continue to depend on China to a large extent.

Decentralization- The solution?

Corona Virus has turned out to be an eye opener for humanity. We have realised that Centralisation is Destructive and Decentralization is the Key to be Strong and more Competent.

Many countries have realised that they were so dependent on China for their raw material and finished product supplies that if China stops selling, they will be finished. China also leads the world in pharmaceuticals and medical supplies. During the COVID19 crisis, all the Nations would require basic medical equipment at large and as China is the only supplier, most nations would run out if the COVID19 continues to rise.

Such necessary requirements to mankind must be decentralized and we should not be dependent on the cheapest supplier all the time. All Nations should have minimum manufacturing of the important products which lead a country.

The economic system is also very centralised. Why do the United States, China and OPEC countries control the global economy? Why did Saudi reduce the oil prices when it knew that it will have a catastrophic effect which would trigger the recession?

Many may die financially due to such a crash if not due to Corona Virus.

Globally we have already lost over 3.5 trillion dollars and are expecting to lose a few more.

If we join the dots we realise that the long recession was triggered on purpose by dropping crude oil prices when the entire world was busy preparing themselves up to battle COVID19.

If

the fall is blamed on Covid19 alone then it should have started earlier in

February itself, and not in March 2020.

It seems that all this was planned as it cannot be a coincidence. As per our

intelligence, many investors pumped in money which had Gulf and Russian offices

in to the stock markets. This could be a plan to drop the prices to trigger the

recession and buy as much as one can in a fire sale like environment. It is not

new. Many global kingpins have kept on investing and doubling their investments

in a couple of days during adverse global market conditions before.

Bitcoin has been the answer to the traditional financial systems which are centralised and are faulty; it is just a matter of time when it will become a part of mainstream economy.

We must figure out ways to ‘Blockchainize’ many manufacturing and financial aspects of our traditional systems once we gather ourselves together from the pandemic. As we see our financial system is going towards a reset. Several measures will be introduced which is a matter of time.

CREBACO Global Inc

Registered off: CREBACO Global Inc. 8 The Green, Ste A, Dover, DE 19901, USA

Singapore: 192 – Skyline Building, Waterloo Street, #07-06, Singapore 187966

Mumbai: TC Gupta Compound Kherani Road, Saki Naka, Andheri East, Mumbai 400072, India

Malaysia: 1-04/05, Medini 7, Jalan Medini Sentral, Bandar Medini, Iskandar, 79250 Johor Bahru

info@crebaco.org | www.crebaco.org